The Kitchen & Bath Market Index (KBMI), conducted by the National Kitchen & Bath Association in conjunction with John Burns Real Estate Consulting, was just released. The comprehensive Q1 report was based on data gathered from the 894 NKBA community members across four industry segments including Design, Building & Construction, Retail Sales, and Manufacturing.

The takeaway? The market is strong when it comes to kitchens and baths—especially in the luxury category. A 15.1% sales growth is expected this year, broken down as 1% growth in volume and 14% grown in prices—a 9.4% increase over the forecast just a few months ago. And while the supply chain is still causing challenges, large renovations are still in high demand and industry sales are strong—yielding an optimistic outlook despite rising inflation costs. In regards to industry challenges, the cost of materials is now the top issue, beating out supply chain disruption (2), cost inflation (3), availability of skilled laborers (4) and capacity shortages (5). These issues have caused increasingly long lead times and large backlogs. On the positive side, Q1 2022 kitchen and bath industry sales grew 12.6% in quarter-over-quarter sales with Design averaging a 13.7% increase, Building and Construction at 13.2%, Retail Sales at 12.1%, and manufacturing at 10.6%.

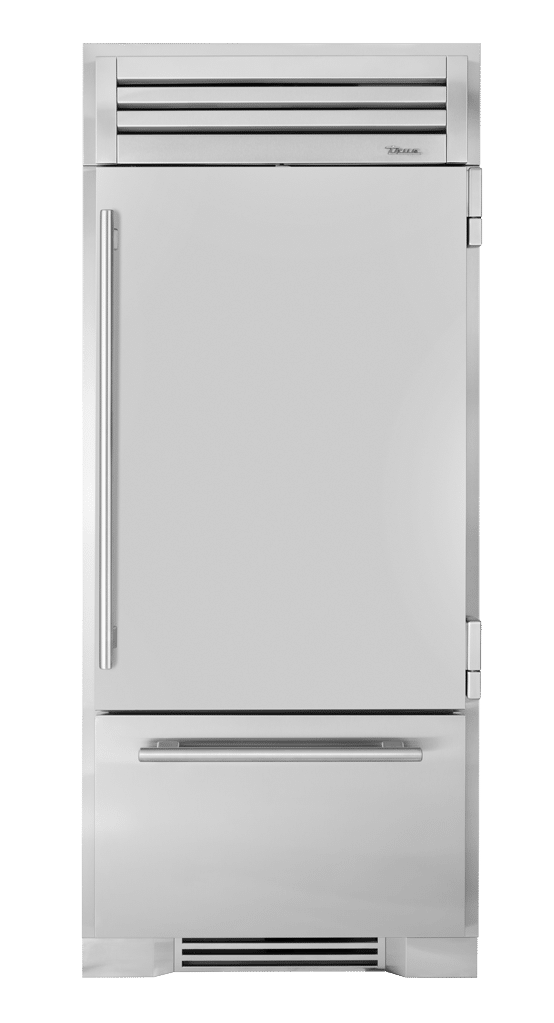

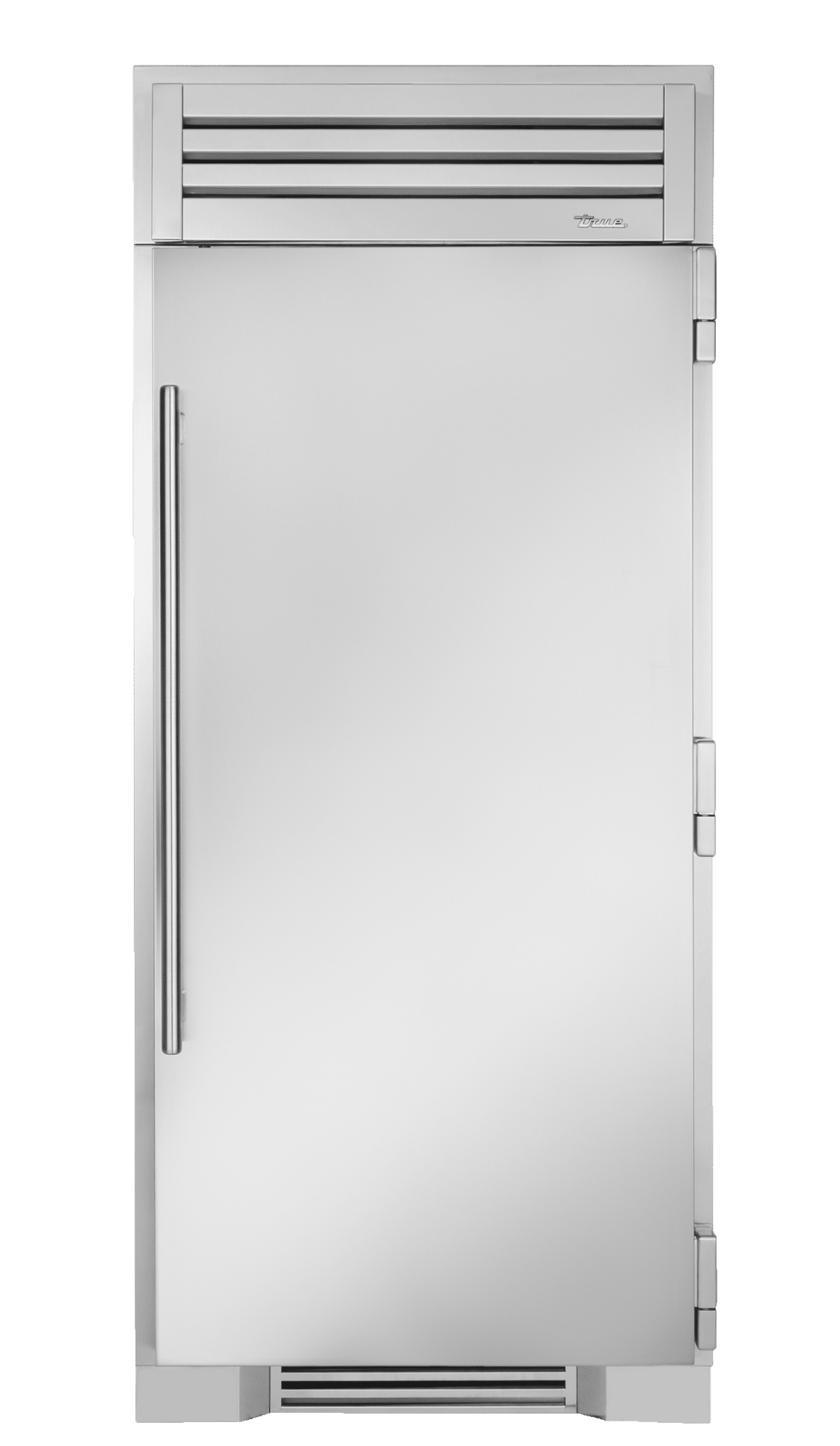

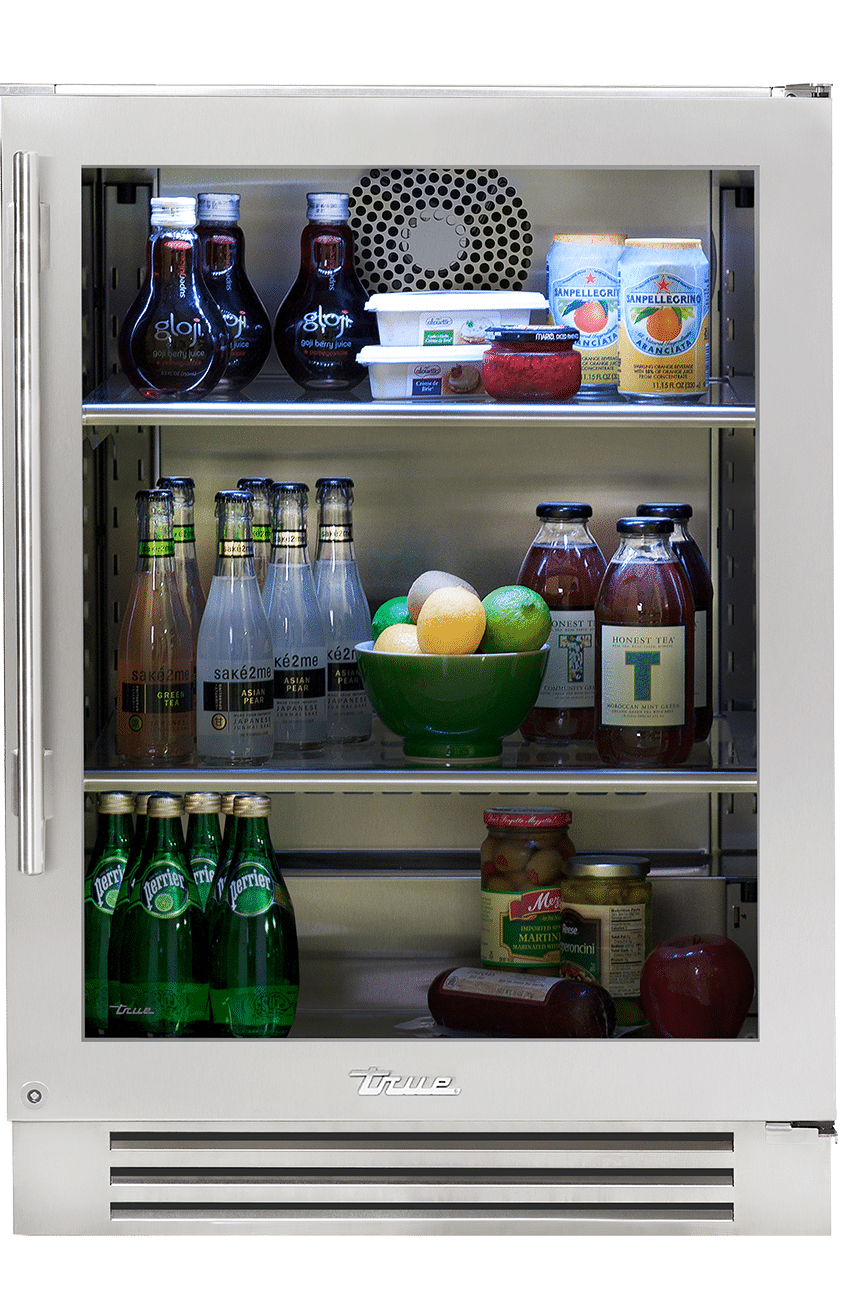

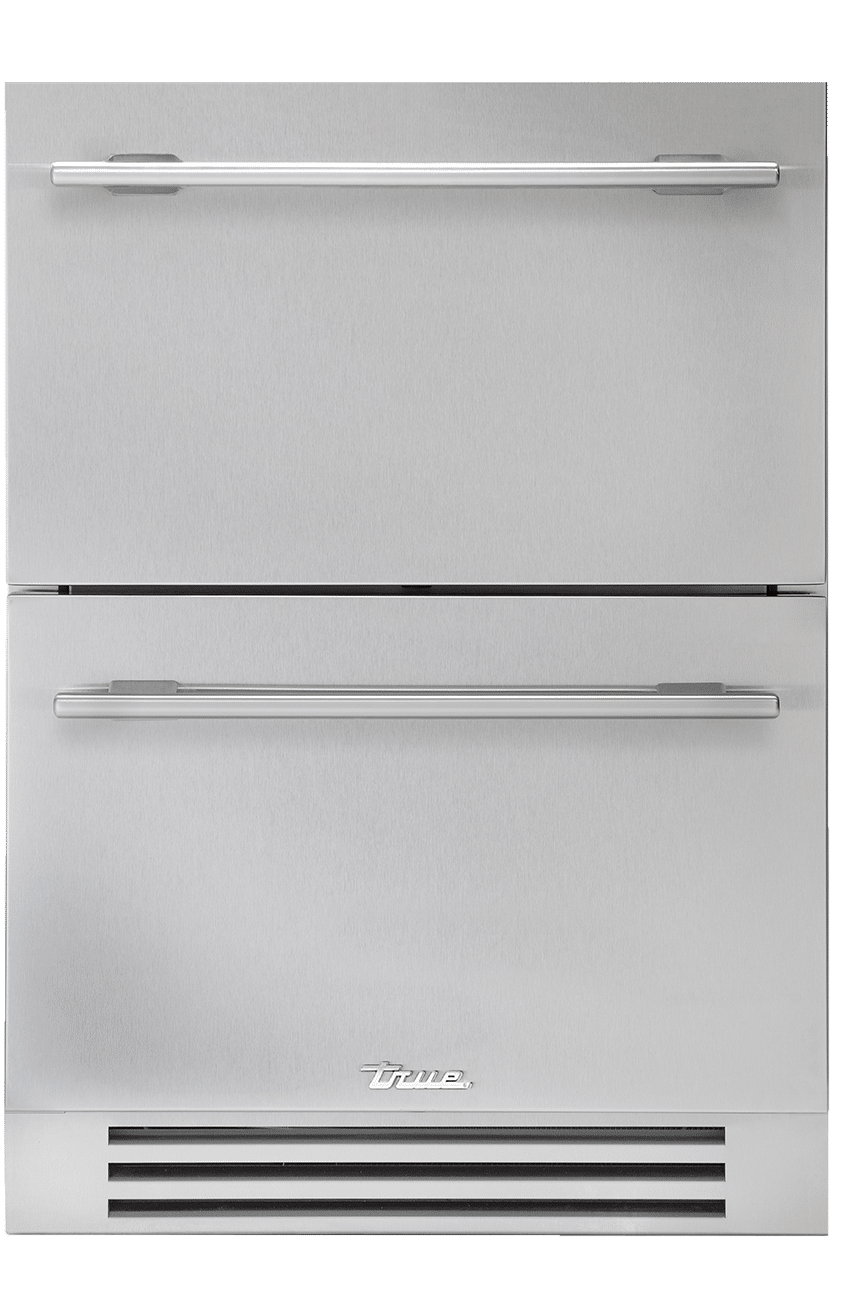

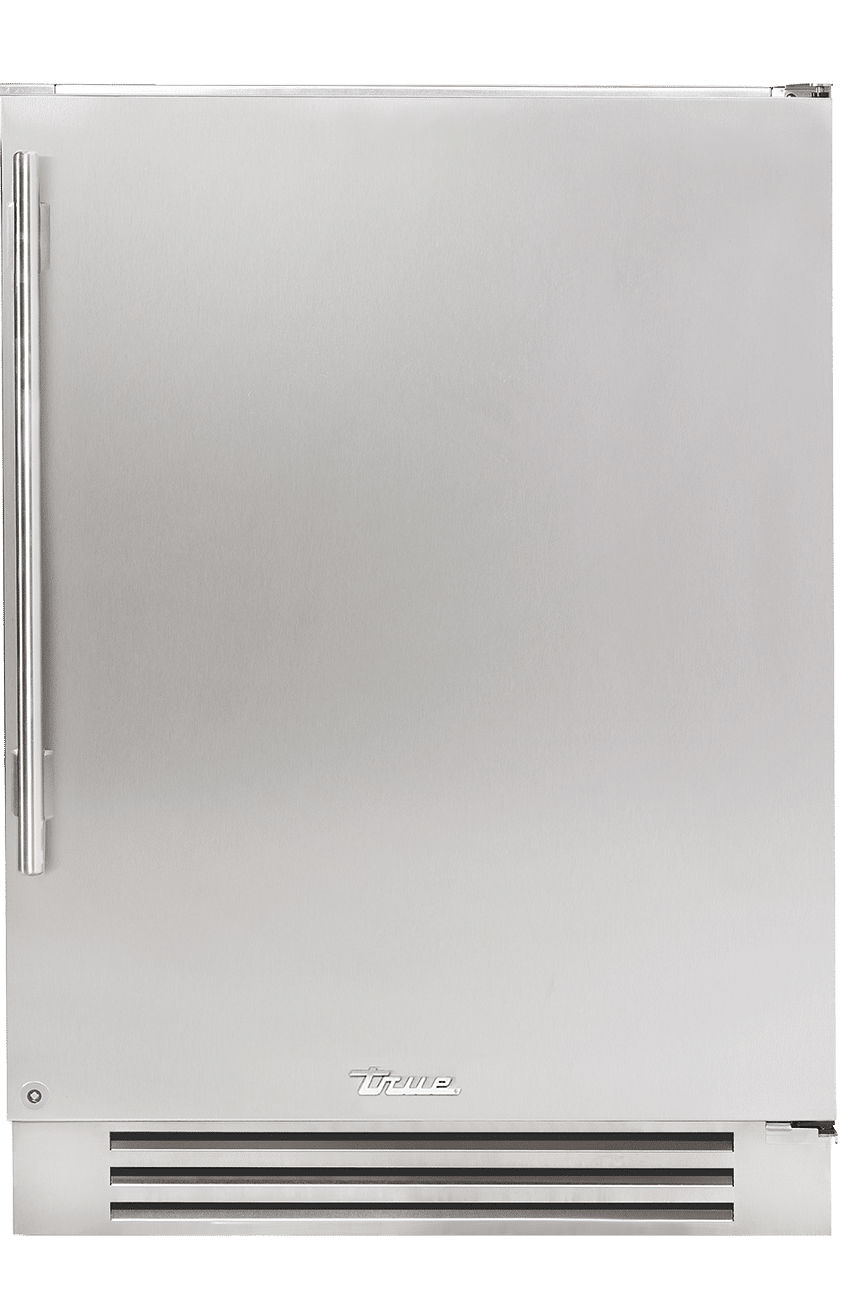

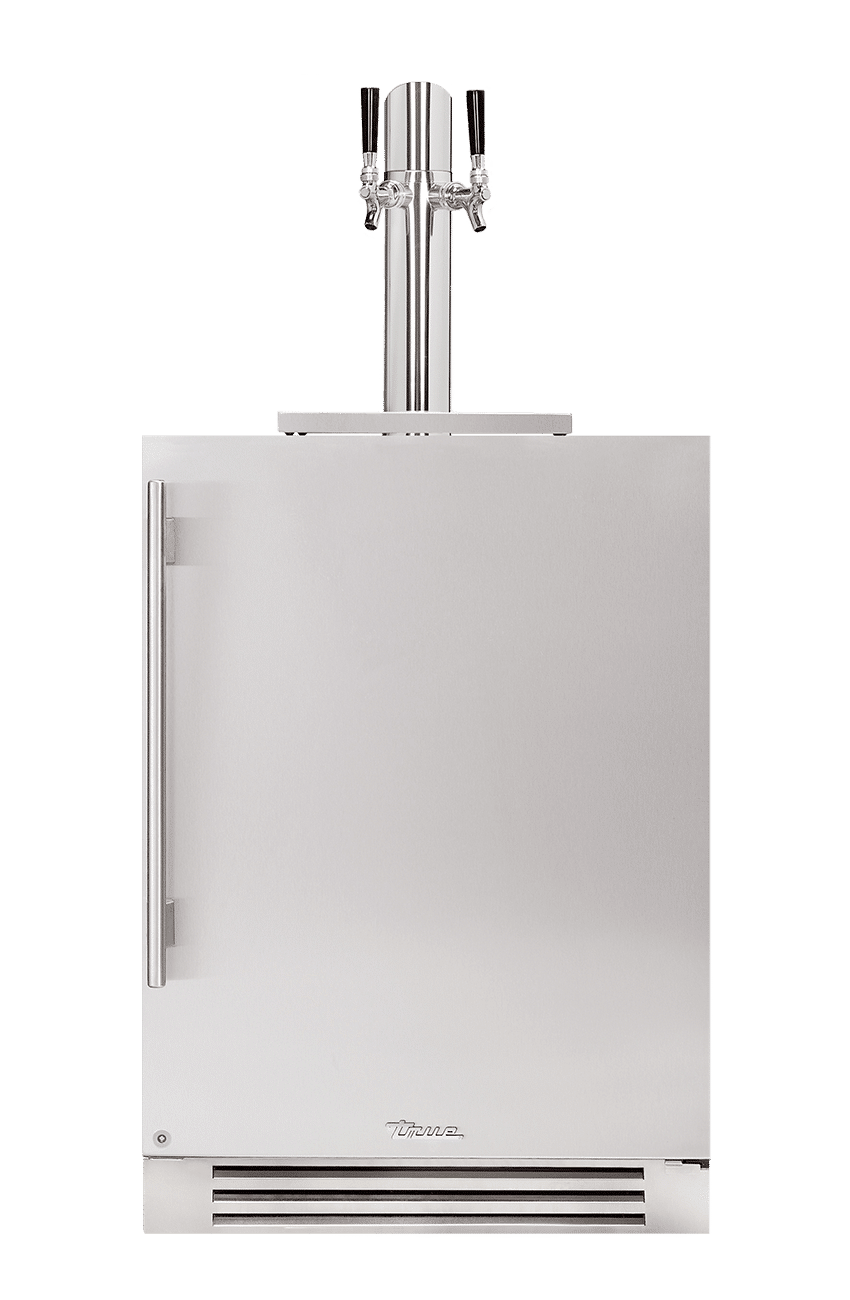

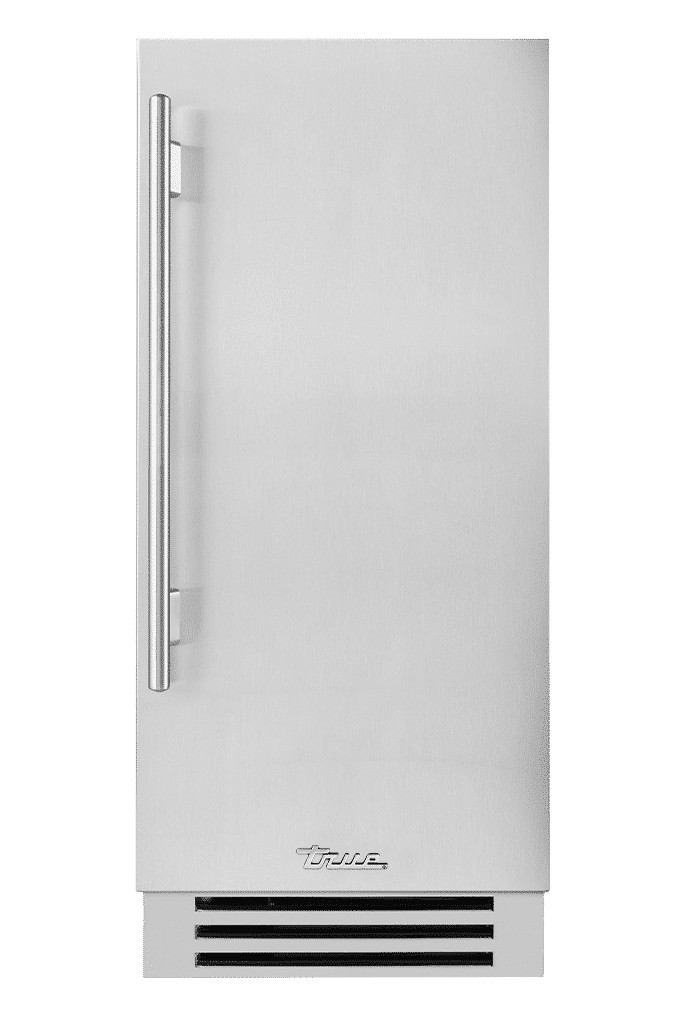

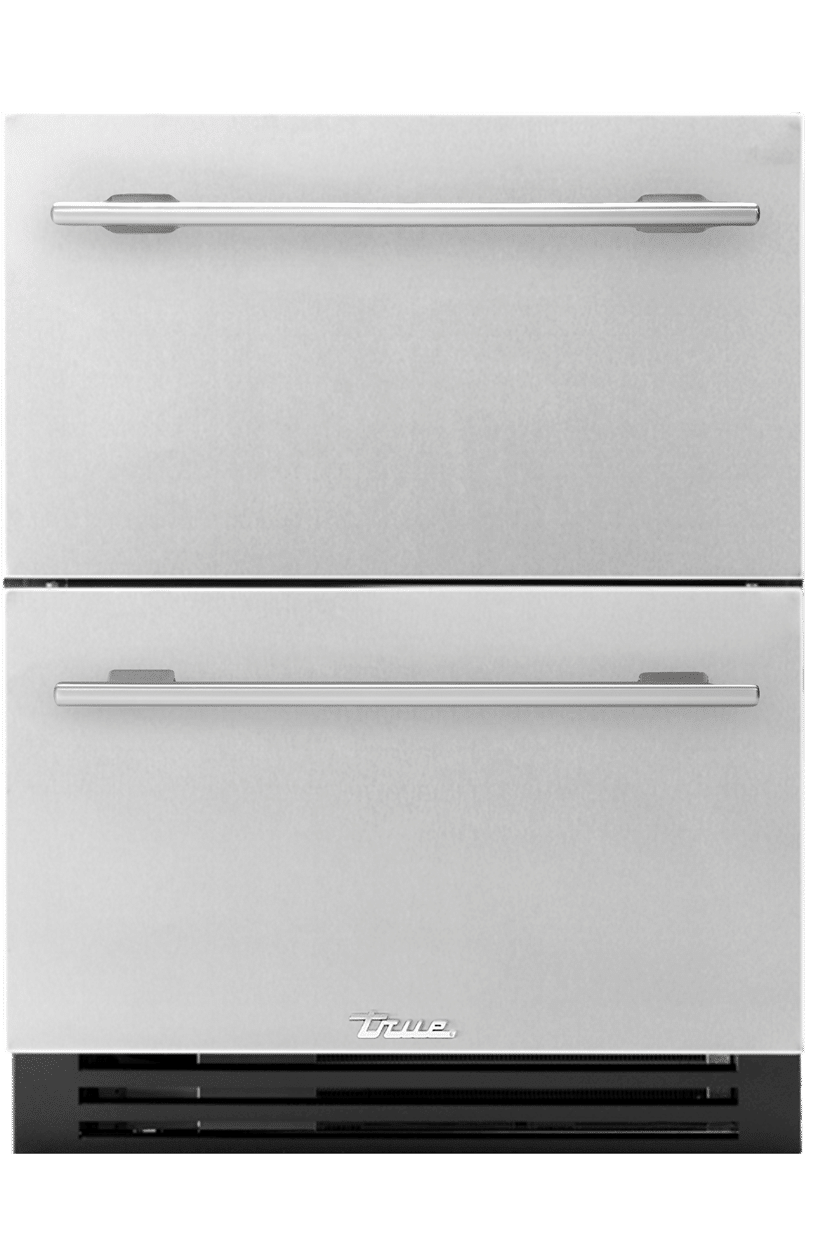

In expected news, Refrigerators were chosen as some of the hardest products to get by 62% surveyed and with 79% of respondents saying luxury products and materials as having the longest lead times. How does that affect True Residential? American companies such as ours are in many cases experiencing a boon because we do produce American-made products. We design and build everything in-house which allows us to pivot to meet market demands. And while brand loyalty is at an all-time low due to availability and demand (many companies have 5-plus month backlogs), we’re pleased to say we’ve been experiencing an uptick in brand loyalty because of our ability to meet demand with lead times that are way less than our competitors while still delivering exceptional refrigeration. Our attention to detail and quality checks have also not faltered in any way and our units continue to showcase phenomenal performance backed by a commercial DNA and exceptional stylistic options. Considering in the Design sector alone, refrigerators are the second-most substituted product behind cabinetry and 21% of designers find refrigerators hard to source, we’re happy to realize in real terms why American-made products are more important than ever. Almost a third of manufacturers surveyed report lead times of over 10 weeks, with 40% expecting 11-15 week lead times, 35% expecting to hit 16–20 week lead times, 15% expecting 21–25 weeks, 5% expecting 26–30%, and another 5% expecting over 30-week lead times.

Labor shortages among increased demand is also affecting businesses negatively and causing a rising labor cost. All the rising costs are resulting in industry professionals and manufacturers raising their prices to maintain margins and retain employees, with clients and retailers taking the brunt of cost increases. Consumers are expected to pay an average of 14% more on kitchen and bath remodels—many now shopping on e-commerce sites before the design process is underway to lock in prices and decrease waiting periods. Of the design firms surveyed, over 55% expect backlogs to get worse and the same amount reported project average size and/or scope increased over the year prior. Building and Construction sectors are reportedly scheduling projects into 2023. Regardless, the good news is that the trend in the Design sector seems to be going towards consumers pausing or postponing projects rather than canceling them altogether when all of these issues arise. Though it is worth noting demand could decline in the next six months if costs continue to rise. Retailers, on the other hand, are struggling to hold on to their margins with rising vendor costs—98% are reporting vendor price increases. Manufacturers are continuing to try to retain their margins, focusing on their most popular SKUs and eliminating lower volume products to increase capacity. We are grateful our American-made roots allow us to continue to offer all of our refrigeration lines.

For a quick summary of NKBA members, according to the organization the base consists of industry professionals such as remodelers, installers, fabricators, trades, kitchen designers, bath designers, interior designers, architects, planners, product manufacturers, cabinet makers, kitchen and bath product suppliers, wholesale distributors, manufacturers’ representatives, dealers, retailers, showrooms, and kitchen and bath e-tailers. While three of the segments experienced a 21% response rate, the Design segment experienced a 28% response rate. NKBA and John Burns Real Estate Consulting release a quarterly report—these reports provide valuable insight into the kitchen and bath market. For those interested in reading the report in full, please click here.